deferred sales trust example

By Greg Reese Certified Trustee for the Deferred Sales Trust. It is also superior to a direct installment sale as the concerns of a.

The Deferred Sales Trust Part 2 Ameriestate

Choosing a deferred sales trust was easy for Peter since he was tired of the 1031 exchangeIt turned out to be about the same monthly income minus most of t.

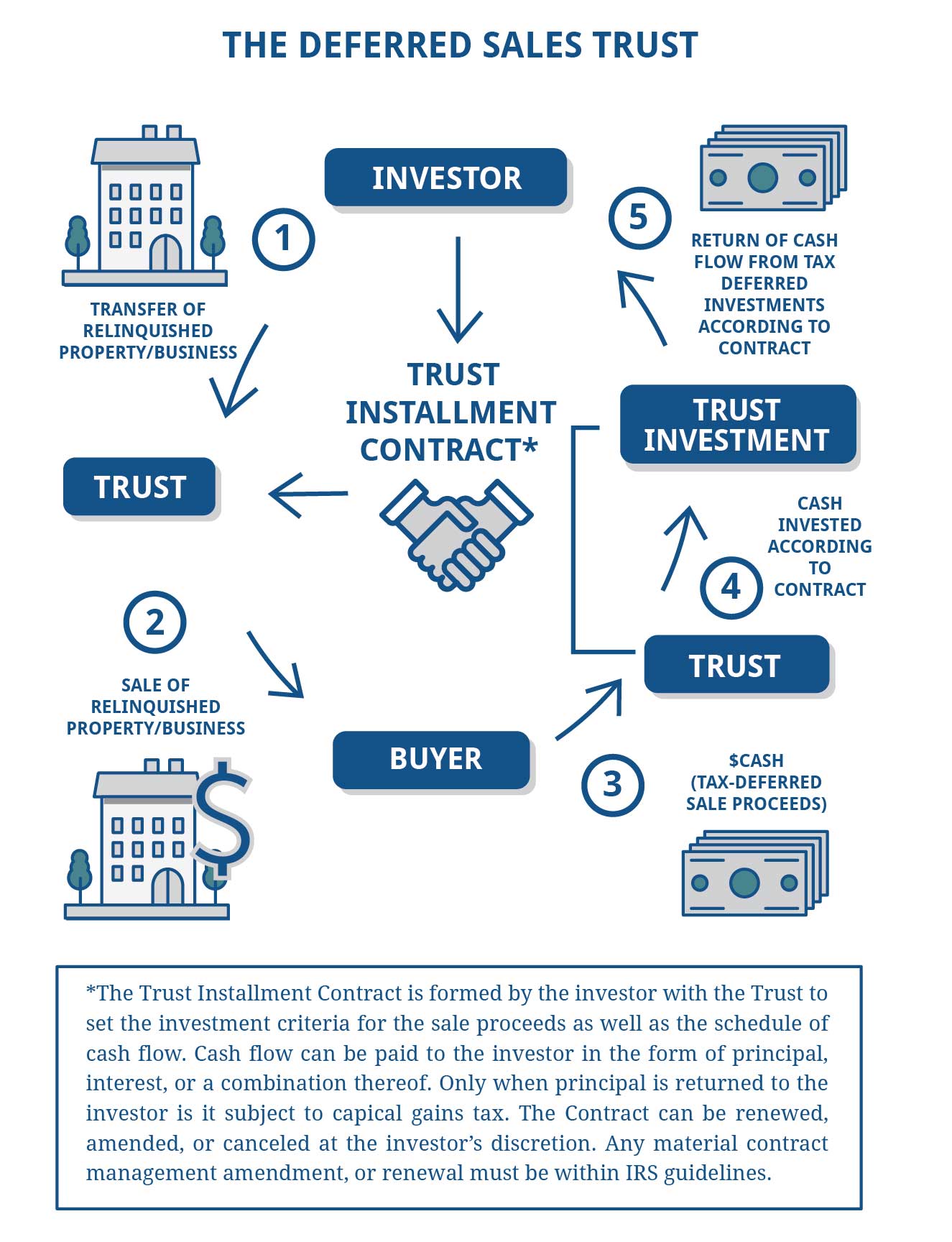

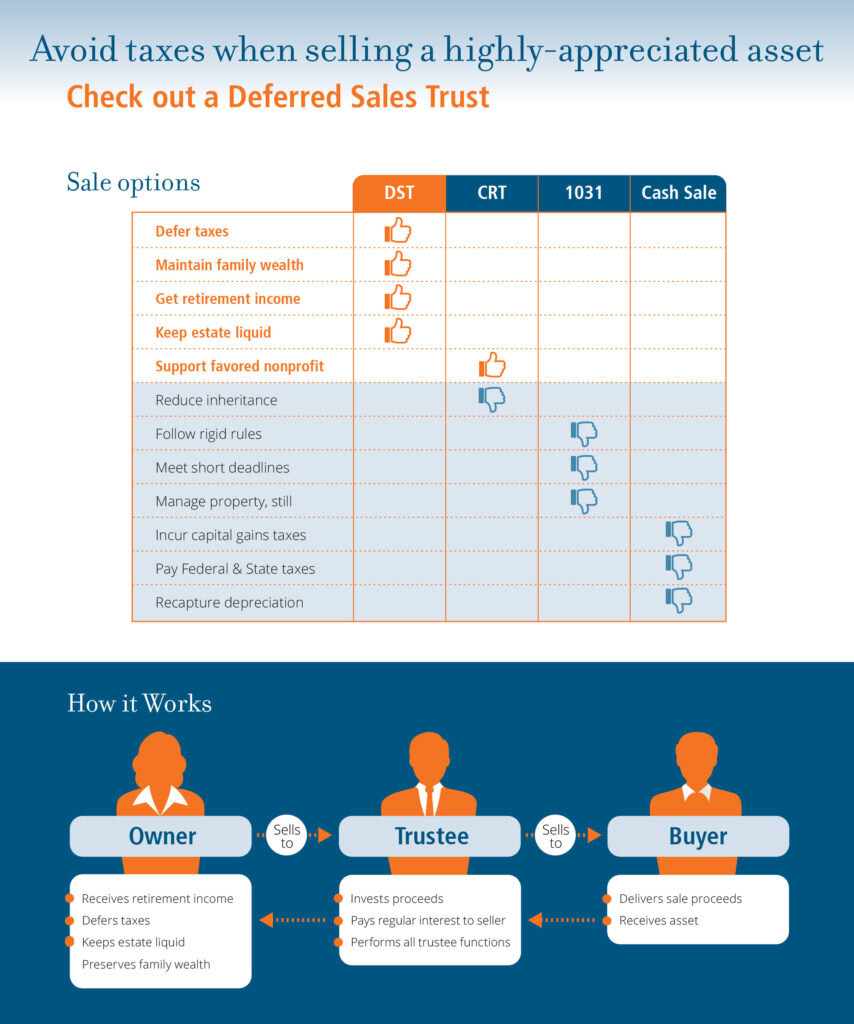

. The deferred sales trust DST is a legal time-tested investment strategy to defer capital gains tax on the sale of your business or property. There are other types of tax-favorable exchanges you may know. The deferred sales trust is the replacement for the private annuity trust.

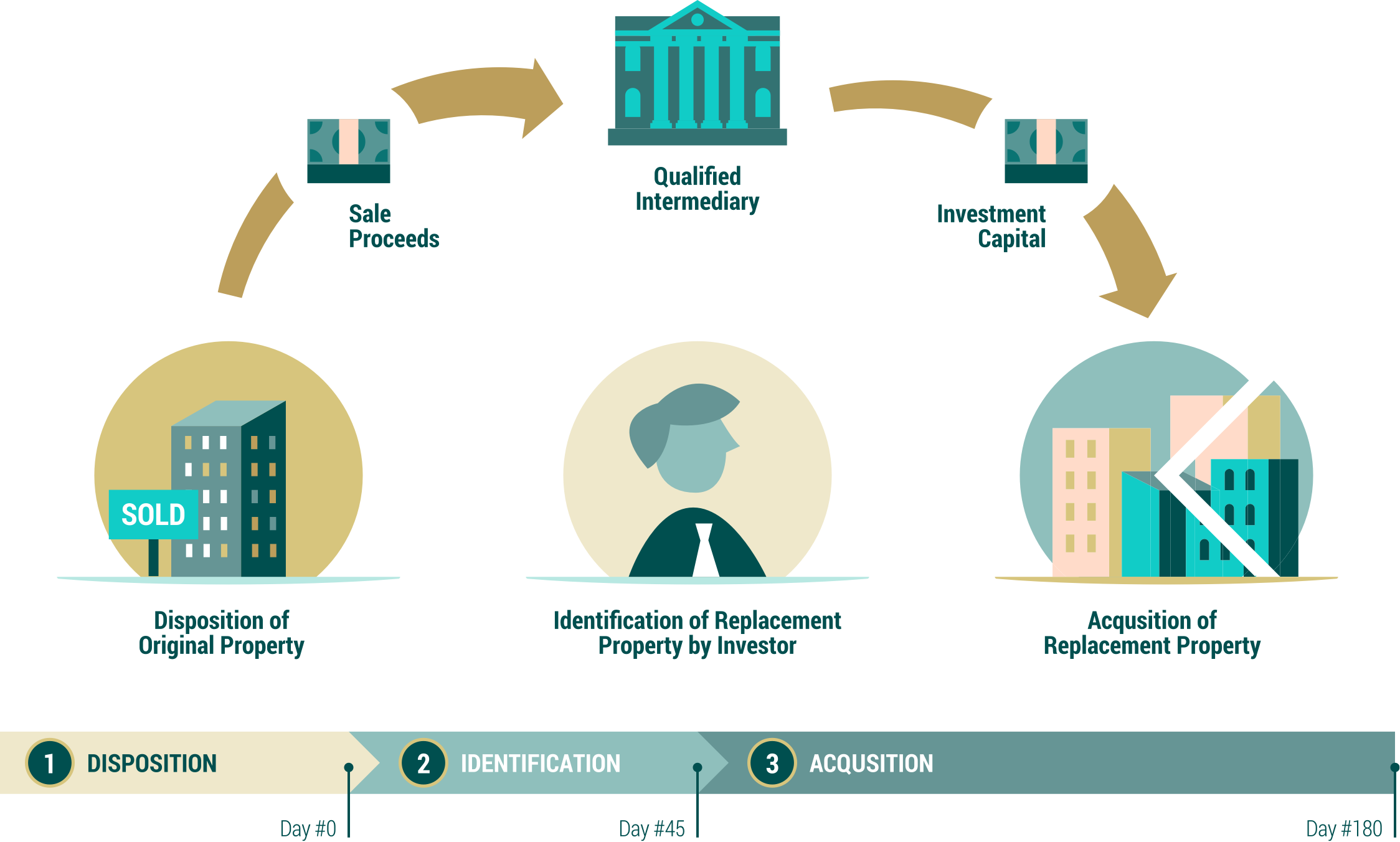

Its called a Deferred Sales Trust and it allows an investor an option to time the market cycles and not be tied to the traditional time constraints of the 1031 Exchange. By using Section 453 of the Internal Revenue Code which pertains to installment sales and related tax provisions it lets people sell a. Deferred Sales Trust or DST.

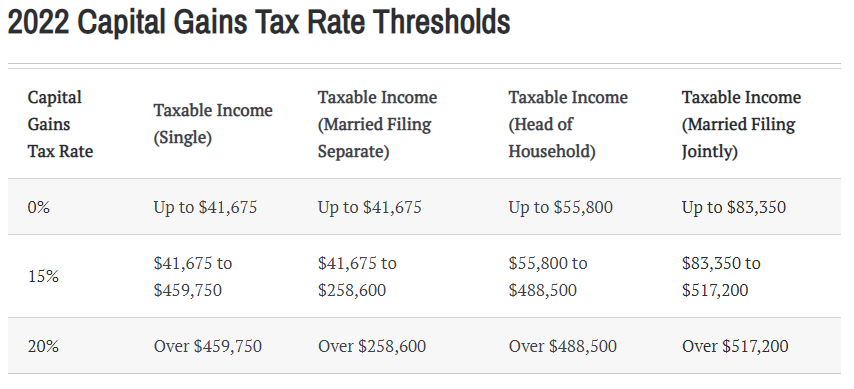

Deferred Sales Trust the assets of which can be managed to each taxpayers own individual risk tolerance and preferences. Capital gains refer to the profit you made off your. Deferred Sales Trust A Capital Gain Tax Deferral Solution Owners of business real estate and other highly appreciated assets are often reluctant to sell due to the significant capital gains.

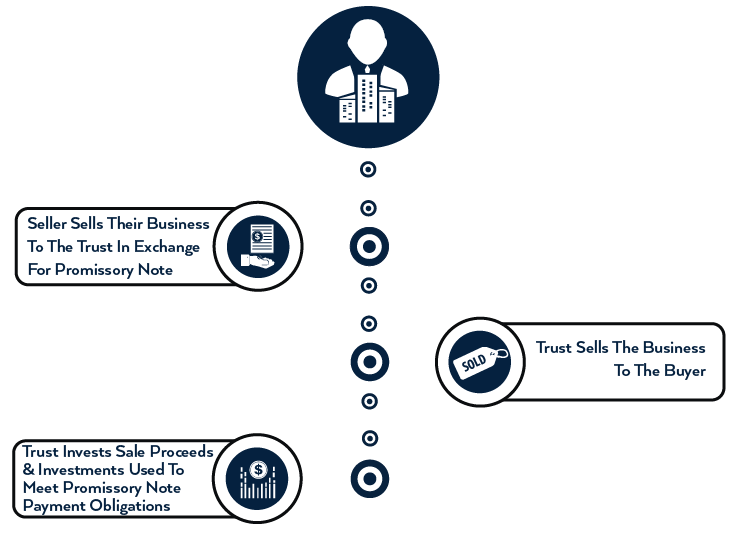

Rather than a typical transaction where the seller would receive funds. Deferred Sales Trust Case Studies. A deferred sales trust DST allows for the deferral of capital gains tax when selling real estate or other qualified assets.

As in a private annuity trust title is transferred to the trustee who then sells the property and puts the. You may be interested to hear the experiences of other business and property owners who have sold their assets to the deferred sales trust. This also works for owner.

The DST is a legal tax-based. The Deferred Sales Trust has the ability to generate substantially more money over the long run than a direct and taxed sale. Today we bring you Part 2 of our series covering the Deferred Sales Trust DST.

Thats where the Deferred Sales Trust comes in. Here is another example of a couple in California selling a highly. Primary Benefi ts of the Deferred Sales TrustTM Estate Tax.

Steve employs a deferred sales trust to sell his 19 million propertyJoin Our No-Cost Deferred Sales. Today Ill discuss a deferred sales trust scenario.

Sell Your Business With Maximum Gains Via Deferred Sales Trust With Brett Swarts Seiler Tucker

Solving Capital Gains Tax With The Deferred Sales Trust Brett Swarts

The Deferred Sales Trust Part 2 Ameriestate

Charitable Remainder Trust Guide Learn With Valur

The 721 Exchange Or Upreit A Simple Introduction

Selling My Business Capital Gains Tax Business Sale

8 Deferred Sales Trust Ideas Trust Capital Gains Tax Capital Gain

Tactics To Reduce Your Capital Gains Tax And Your Estate Tax

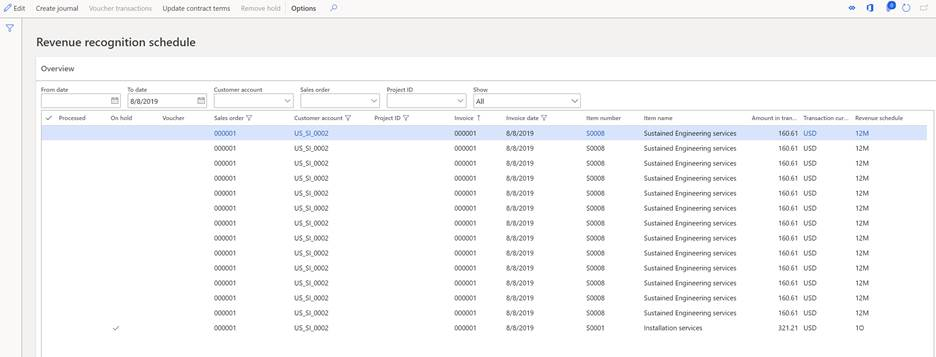

Recognize Deferred Revenue Finance Dynamics 365 Microsoft Learn

Deferred Sales Trust Defer Capital Gains Tax

Sell Your Business With Maximum Gains Via Deferred Sales Trust With Brett Swarts Seiler Tucker

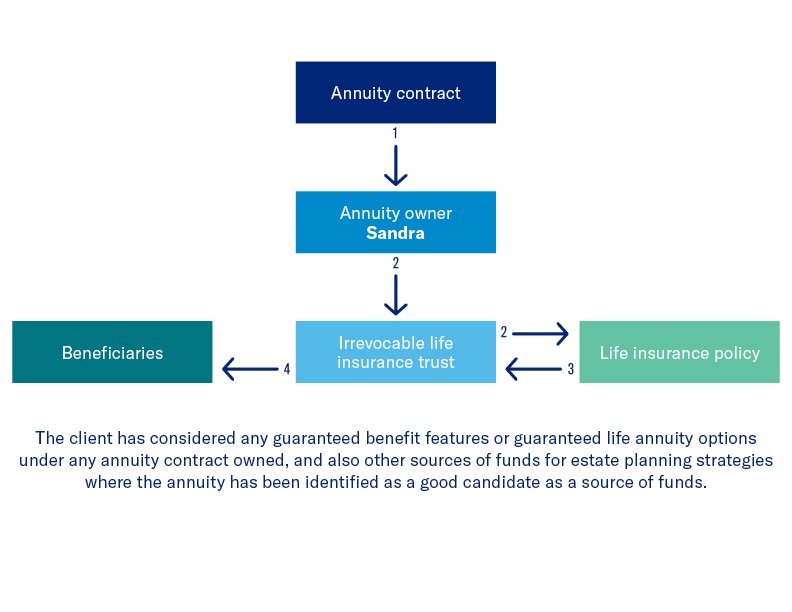

Increasing Wealth Transfer Using Deferred Annuity Distributions

Deferred Sales Trust The 1031 Exchange Alternative

Deferred Sales Trust Defer Capital Gains Tax

Deferred Sales Trust A Tax Strategy For Investors Fortunebuilders

Five Compelling Reasons To Consider A Deferred Sales Trust Atlas 1031

Deferred Sales Trust O Connell Investment And Insurance Services